Pan Card

Pan Card

Pan Card: How To Link Pan Card With Aadhar Card

PAN stands for a Permanent Account Number. It contains a 10 digits alphanumeric number issued by the income tax department to Indian taxpayers.

Nowadays It has become a compulsory process to link your PAN card with an Aadhar card. This is an important process because this will allow your income tax returns to be processed. When you are making a transaction of 50,000 or more than that then you must have your PAN card linked with your aadhar card.

The process of linking PAN Card with an aadhar card is very simple you can do that in just a few steps.

How many ways can we link PAN with aadhar card

There are two ways by which you can complete the process of linking of PAN card:

- Through income tax e-fiiling website.

- Through sending an SMS to 567678 or 56161

Visit “Income Tax Site”

Open any search engine which is suitable to you and search Income Tax Site.

Visit To "Income Tax Department" Website

Click on the first link in search results as shown in the above image.

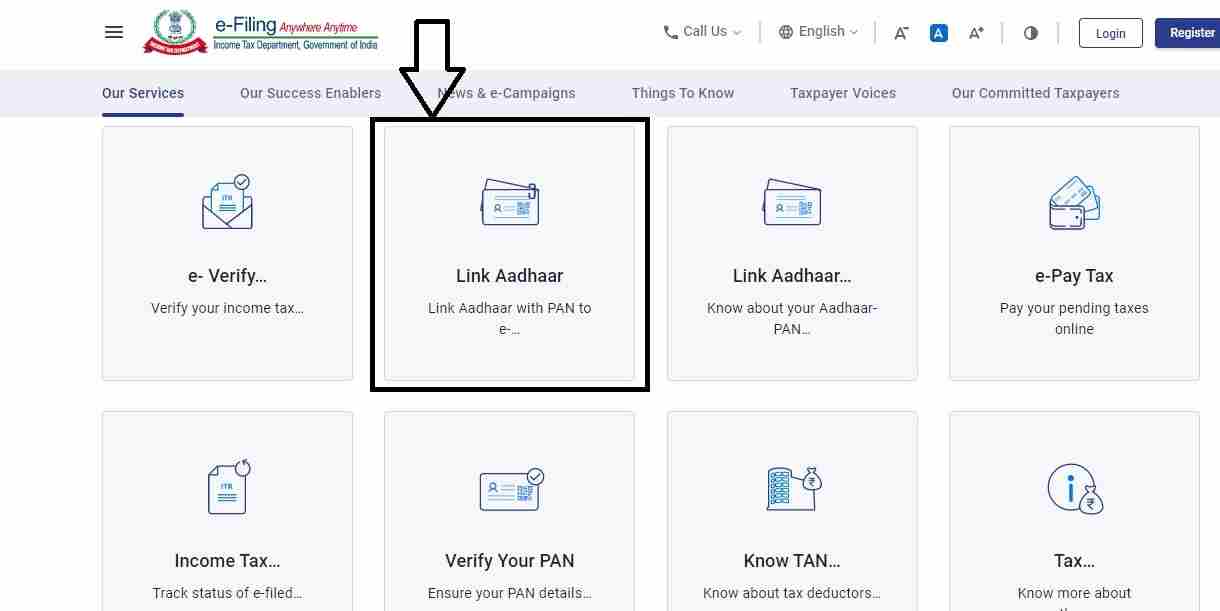

Click On The "Link Aadhaar" Box

As shown above, click on the Link Aadhar Blog" Box.

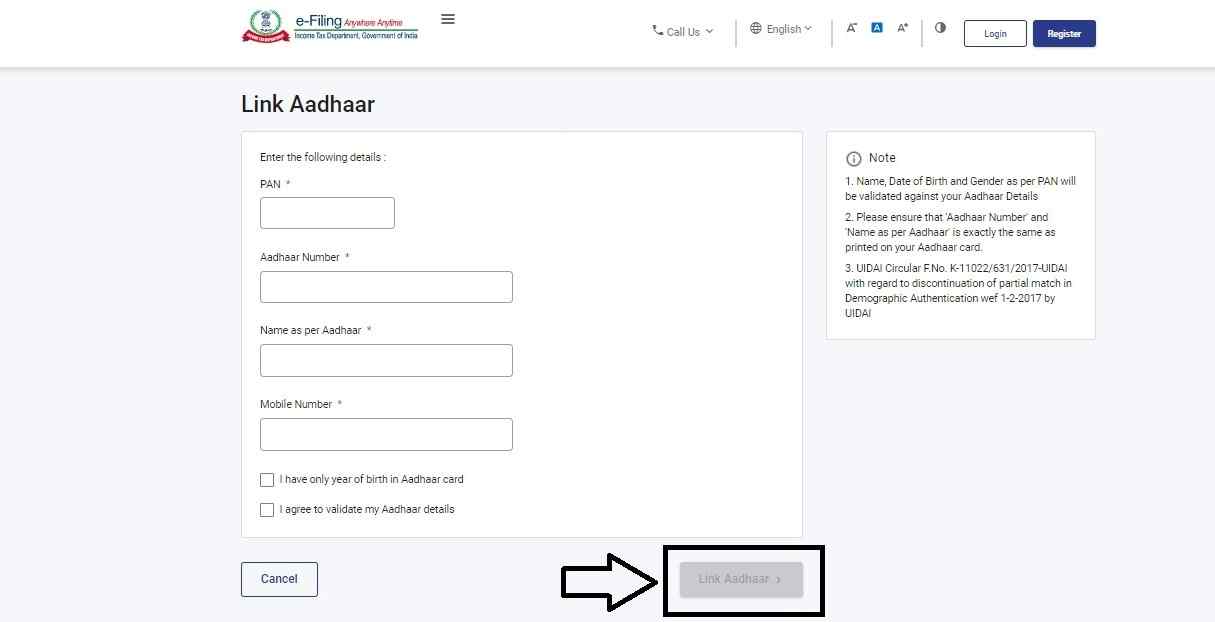

Provide Required Details

Enter all the details like PAN Card Number, Aadhar Card Numer and Name which is mentioned in the aadhar card and Registered Mobile Number.

Tick On "I Agree To Validate My Aadhar Details"

Tick on the square if only the birth year is mentioned in the Aadhaar card and also tick “I agree to validate my aadhar details”.

Submit Your Form

Finally, click on Link Aadhar Button to submit your form.

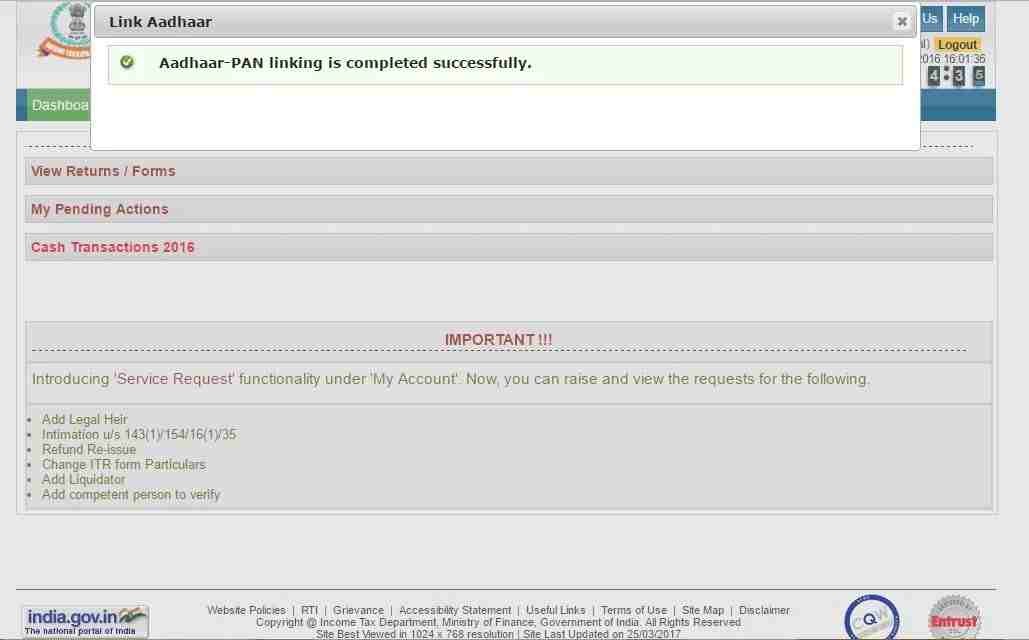

Finally, Its Done

Finally, Aadhar-PAN Linking Is Completed Successfully.

Pan Card: How To Link Pan Card With Aadhar Card

Pan Card: How To Change Name On PAN Card

Apply Duplicate Voter Id Card: Learn How To Apply For Dupli

Voter Id Card: How To Transfer Voter Id Card

Check voter id card status: a guide on how to check the st

Download Voter Id Card: How To Download Indian Voter Id Car

Aadhar Card: How To Book A Slot For Aadhar Card