Pan Card

Pan Card

Pan Card: How To Apply For Pan Card

PAN (Permanent Account Number) is a unique 10-digit alphanumeric character assigned to all taxpayers in India. The Indian Income Tax Department matter PAN under the Indian Income Tax Act, 1961 under the supervision of Central Board for Direct Taxes.

Permanent Account Number is an electronic system that records all details related to tax – of a company or a single– against a single PAN number. It is the primary key for reserving information, which is shared beyond the country. PAN card is well-founded for a lifetime.

Search “NSDL” On Google

Open google home page and search NSDL

Click On "NSDL Online PAN Applicants”.

After this, you need to click on NSDL Online PAN Applicants which appears as a first in the google results as shown above.

Provide Necessary Details

Fill out all the required details. For example Applicant Type(Form 49A for Indian citizens) ,Category(Individual), Title(Shri/Smt/Kumari),Your name , Contact Details etc.

Now, Verify Captcha

Enter Captcha Verification code which shown on the right side And Click Submit button. Note Down Token number and continue with the pan application.

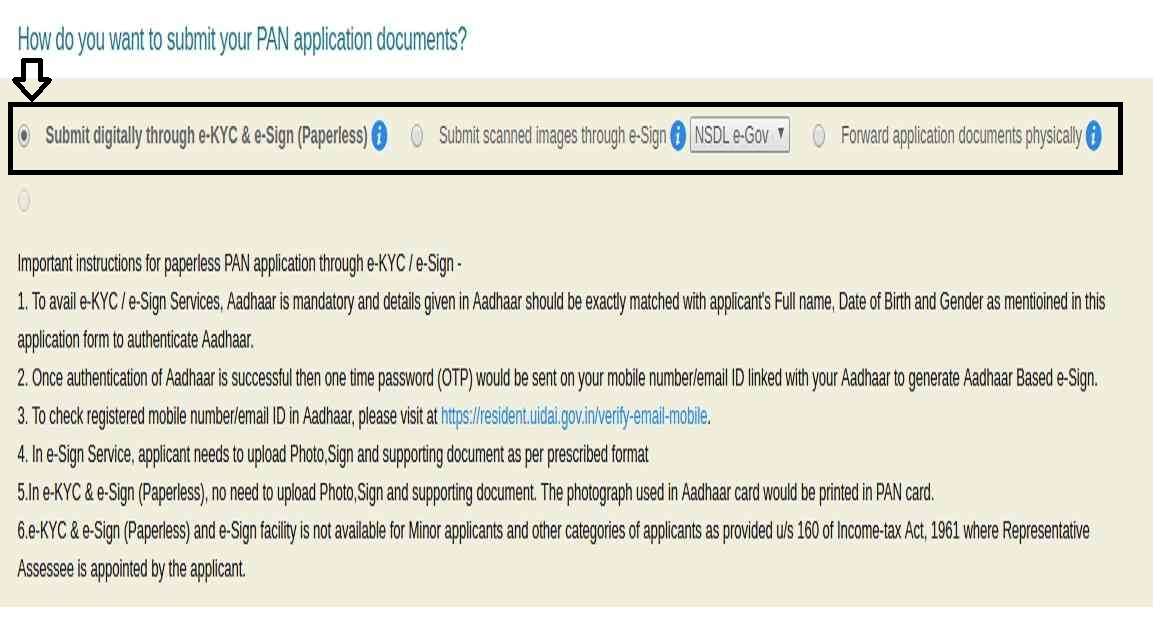

Pan Application Documents.

Here You have 3 options using which you have to submit documents for pan application. You can submit documents digitally using e-KYC or submit scanned images by e-sign or you can give documents physically. Choose the document submission option and read the instructions carefully and click on Next button.

Contact Details

Here, you need to fill in your source of income and address details. Here you have a facility to save the information at this stage by clicking Save Draft

AO (Assessing Officer) Details

Here, fill out the AO Details to access the tax jurisdiction you qualify for.

Details About Submitted Documents

Finally, Enter details about the documents which you submitted for the pan application. Here, you also be asked to submit your signature and photograph, upload this and click on Submit button.

After Submitting the application and making the payment, you will get an OTP on your registered mobile number So, verify yourself by entering the OTP And print the 15 digit acknowledgement number receipt.

Sign this receipt of acknowledgement number and courier to NSDL office within 15 days from the application date.

Why Pan Card Is Important

PAN Card is important for person who pay tax as it is necessary for all financial transactions and is used to track the inflow and outflow of your money.

PAN Card can be classified as:-

- Hindu Undivided Family

- Company

- Trusts

- Society

- Individuals

- Partnership

- Foreigners

Why should you enroll for PAN card?

The individual Permanent Account Number is of immoderate importance not only for income tax purpose but also because it enables every entity in India with the following –

- Proof of Identity

- Proof of Address

- Business Registration

- Gas Connections

- Financial Transactions

- Compulsory for Tax filling

- Phone Connection

- Operating and opening Bank Accounts

- Mutual Funds

Documents Required to Apply for PAN Card

The following documents are needed to change name on PAN card –

- Aadhar card

- Voter id

- Passport

- Driving License

- Newspaper advertisement featuring your updated name

- Passport of the husband if you want to change surname after-marriage.

Pan Card: How To Link Pan Card With Aadhar Card

Pan Card: How To Change Name On PAN Card

Apply Duplicate Voter Id Card: Learn How To Apply For Dupli

Voter Id Card: How To Transfer Voter Id Card

Check voter id card status: a guide on how to check the st

Download Voter Id Card: How To Download Indian Voter Id Car

Aadhar Card: How To Book A Slot For Aadhar Card